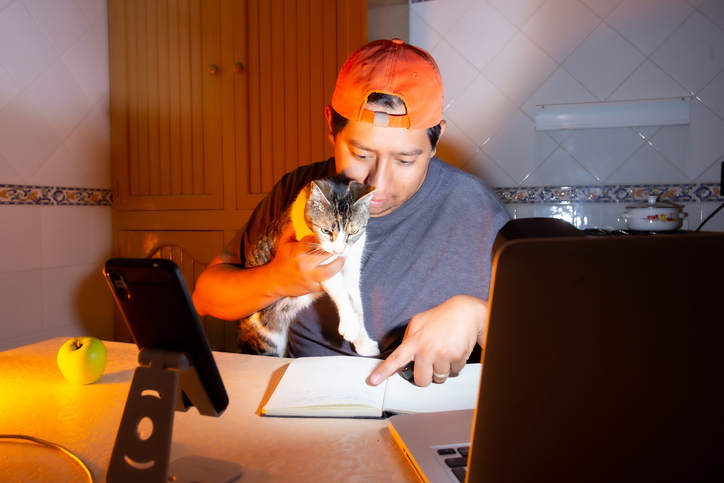

With rising food costs and SNAP under attack, more of our neighbors are at risk of going hungry this holiday season.

Together, we’re making sure every family has enough to eat.

Other Ways to Give

Stock

Own stock, mutual funds, or have stock options available through your employer? Make a great gift with greater impact while enjoying a double tax advantage when you give to United Way via stock.

Donor Advised Fund

Requesting a grant from your Donor Advised Fund as a gift to United Way is a simple, straight-forward, and tax-efficient process.

IRA Charitable Rollover

Give from your Individual Retirement Account (IRA) through a Qualified Charitable Distribution. A Qualified Charitable Distribution (QCD) is a tax-efficient way for those 70 ½ or older to donate from their IRA, while also counting towards your annual Required Minimum Distribution.

Crypto

By donating appreciated crypto to United Way, you can avoid taxes and maximize impact, especially for those with substantial gains. Holding crypto for over a year may lead to federal tax deductions up to the full gift value.

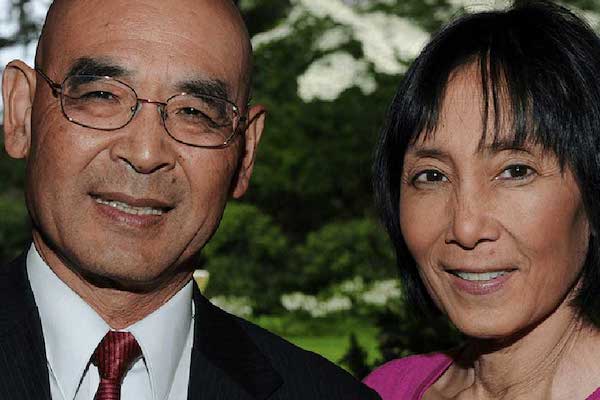

Legacy Giving

Interested in powering the impact of United Way into the future? Leaving a legacy gift to United Way can easily be added to your will, living trust, or to a retirement account as a beneficiary in as little as one sentence.

For any questions, please contact Jennifer Trice at (206) 461-3245 or jtrice@uwkc.org for more information.

United Way of King County is a 501(c)3 tax-exempt nonprofit organization and your donation is tax-deductible within the guidelines of U.S. law. To claim a donation as a deduction on your U.S. taxes, please keep your email donation receipt as your official record. We’ll send it to you upon successful completion of your donation. On average, 95 cents of every dollar donated goes to meet community needs.