Take Advantage of New Tax Credit for Washington Residents

The IRS said in November that 2023 tax refunds may be smaller than previous years, citing the lack of additional stimulus payments and changes to charitable contribution deductions. Fortunately for Washington state residents, a new tax credit for families might offset the shortfall.

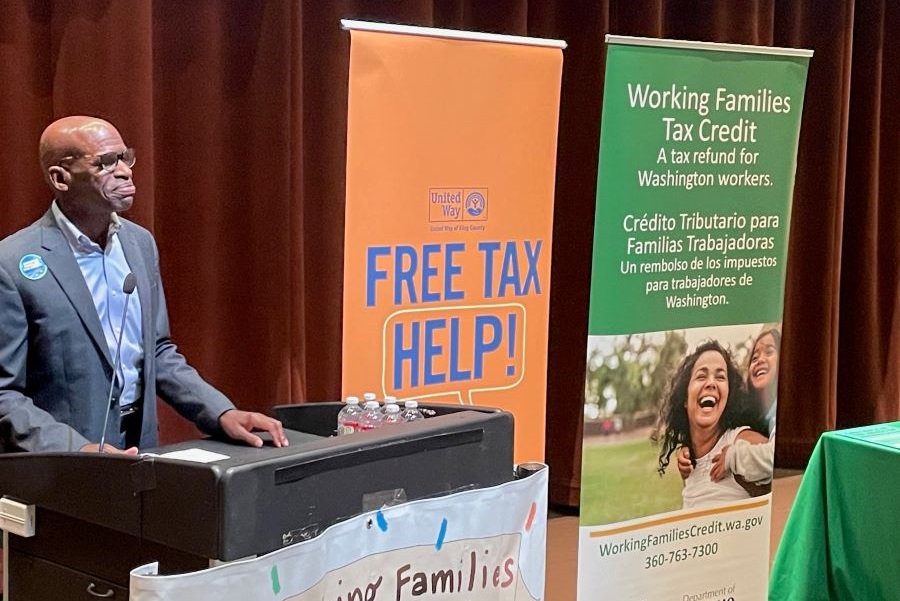

Last week United Way of King County and local government officials announced the Feb. 1 launch of the Working Families Tax Credit, a deduction that will give yearly cash payments of as much as $1,200 to nearly 400,000 low-to-moderate income households in Washington state. Families are free to use the credit however they wish to meet their needs.

United Way president and CEO Gordon McHenry, Jr. outlined the tax credit provisions at Seattle Public Library’s main branch, which houses one of United Way’s Free Tax Preparation Campaign sites. With the average cost to file a return now more than $200 annually, United Way’s Free Tax Prep Campaign offers those who make less than $80,000 opportunities to keep more of their earnings.

“These are our neighbors,” said McHenry about those eligible for the Working Families Tax Credit. “The journey to an equitable society takes time, it takes intentionality and it takes good policy. We are so excited to help King County residents access the Working Families Tax Credit this year at all our tax preparation sites.”

In King County alone, 96,934 households will be eligible for the Working Families Tax Credit. Their windfall could result in a $54 million revenue influx to the local economy, county officials said. Unlike other similar federal tax credits, the WFTC will also be available to undocumented immigrants and others who file taxes with an Individual Taxpayer Identification Number.

The Working Families Tax Credit will also have an outsized impact for communities of color across the state who are disproportionately lower income due to racist policies that have prevented communities of color from building wealth.

“United Way has been part of a coalition working to advance the Working Families Tax Credit for more than a decade,” McHenry added. “Good policies sometimes take a long time to enact, and that’s really important because many of our societal problems go back hundreds of years.”

Also, in attendance at the Working Families Tax Credit launch was Nijhia Jackson of Bremerton, who said that tax credits have eased her family’s financial burdens, particularly during the COVID-19 pandemic.

“During COVID, my family was able to receive the tax credit and it really helped,” said Jackson, an events cashier at Tacoma Dome. “When those payments came, I could finally do a little bit; I was able to buy school clothes and shoes for my kids to wear instead of hunting through stuff at Goodwill.”

In King County, free Working Families Tax Credit application assistance can be found through United Way’s Free Tax Prep Campaign. United Way of King County also helps people apply for or renew their Individual Taxpayer Identification Numbers, making it easier for immigrants to apply for and receive their WFTC. For more information or to locate one of our Free Tax Prep sites, log onto https://www.uwkc.org/need-help/tax-help/.

Comments